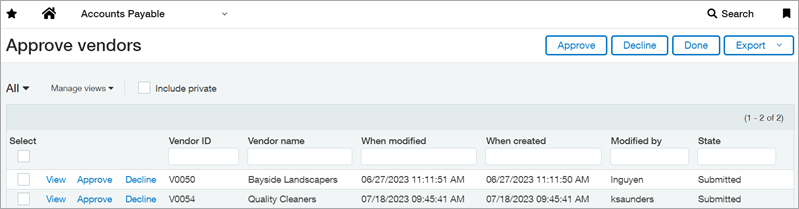

Accounts Payable vendor approval

Now, you can manage your vendor approval process directly within Sage Intacct, ensuring the correctness of vendor records before the information is used in Accounts Payable and Purchasing transactions.

While a vendor record is pending approval, new Accounts Payable and Purchasing transactions for that vendor can be saved as drafts, but they cannot be posted. After the vendor is approved, the transactions can be posted.

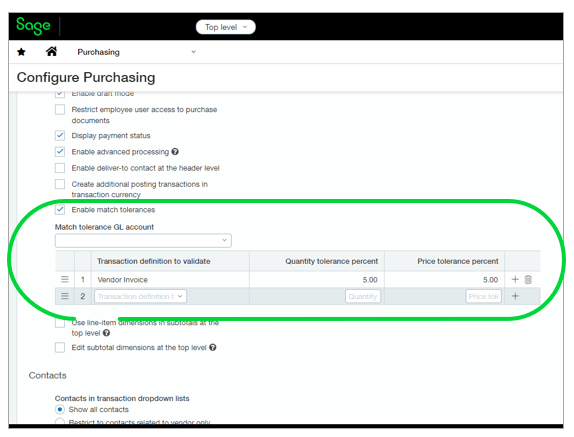

Match tolerance for Purchasing transactions

With match tolerances, Sage Intacct automatically compares the quantities and unit prices that appear on converted Purchasing transactions. It increases your business controls by:

- Reduces the risk of fraud and financial loss by preventing the reimbursement of unauthorized purchases.

- Identifies frequent mistakes on receipts and vendor invoices that can be a sign of a broader business issue.

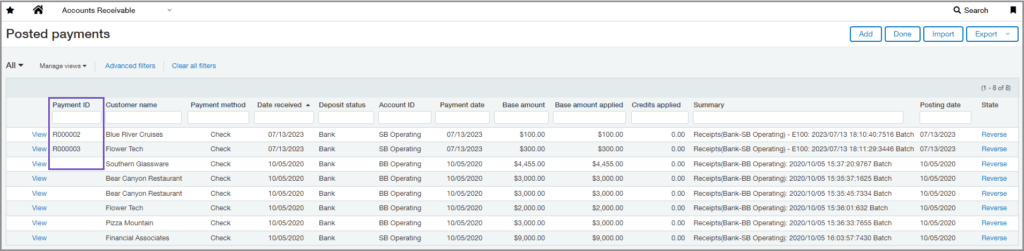

Accounts Receivable payment ID

With document numbering sequences, Intacct automatically generates new IDs for common transactions and records. First, you set up a document sequence for AR payments. Then, Intacct automatically generates a Payment ID for all newly posted payments.

This allows you to track specific posted payments, and filter and report on those payments. For example, if you have a posted payment that was applied to multiple invoices and adjustments. You can run a custom report based on the Payment ID to see which transactions the payment was applied to.

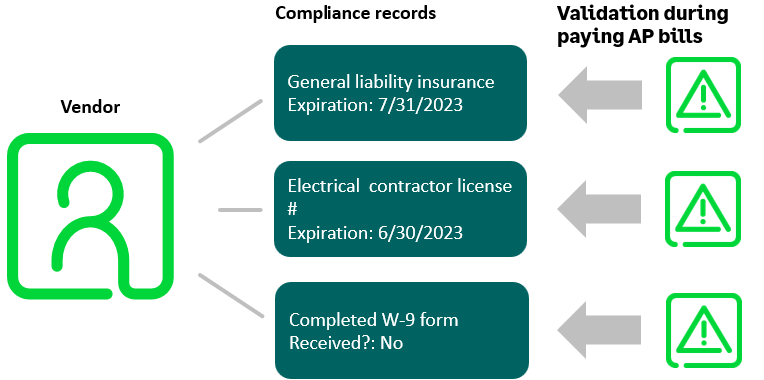

Construction vendor compliance

You might require contractors to have adequate liability insurance or a specific license. Now, you can define compliance requirements, specify whether to validate by document or expiration date and optionally prevent bill payments to out-of-compliance vendors.

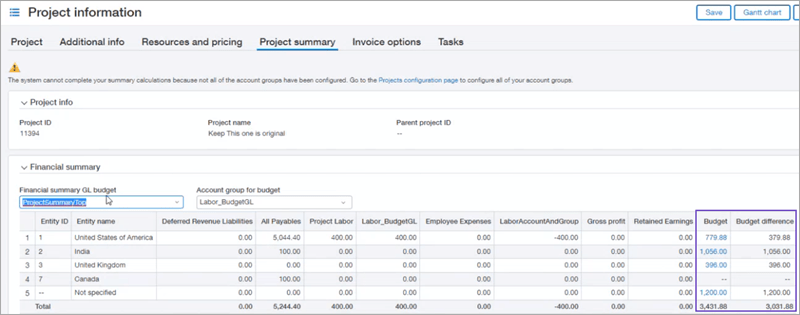

Project budget insight on your project summary

Project budget information now appears on your Project summary tab.

Contracts revenue recognition on invoice

Sage Intacct’s Contracts application includes both a powerful subscription billing engine and fully automated revenue management. This combination supports a multitude of billing and deferred revenue scenarios that work seamlessly together. But what if you do not always need to defer revenue and simply want to record revenue when you bill a contract line?

In this release, Contracts includes an optional workflow that eliminates the requirement to defer revenue for a contract line. And if you have some contract lines that do need deferred revenue, no problem—you can mix and match revenue workflows in the same contract.