Featured Posts

-

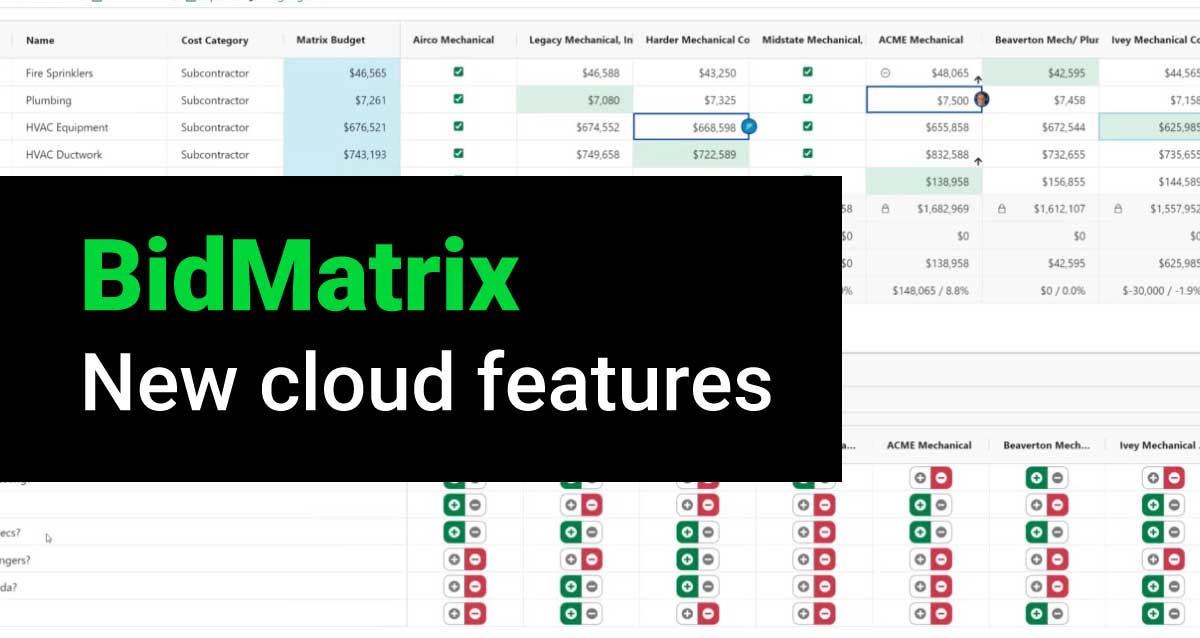

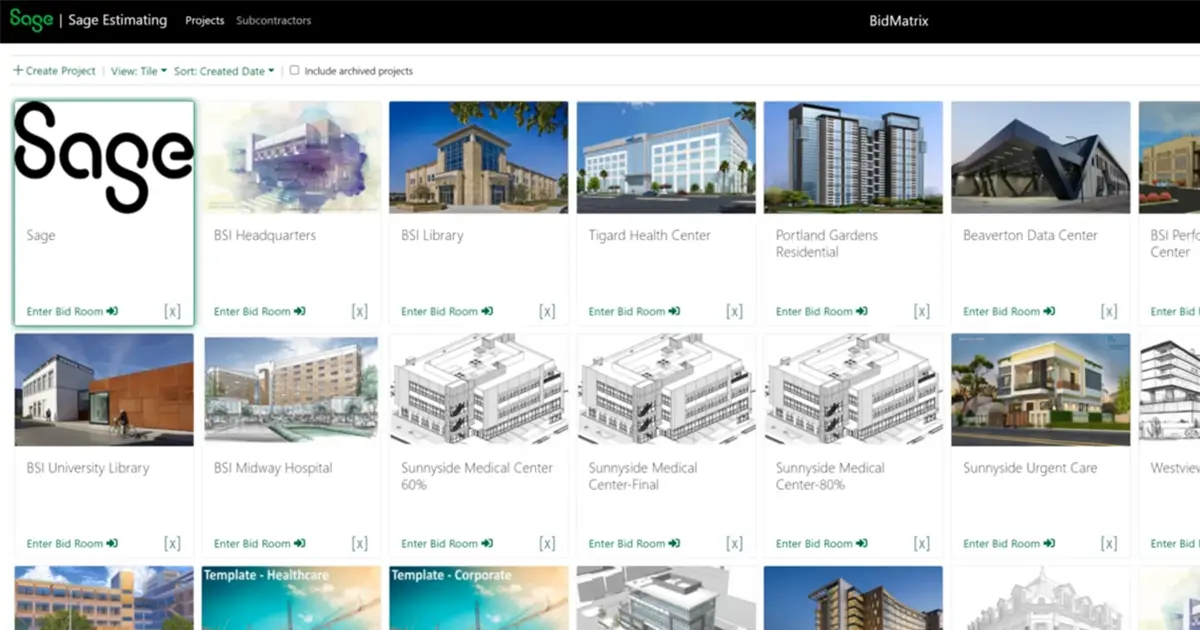

Win More Bids with Sage BidMatrix

Sage BidMatrix, embedded in Sage Estimating, offers a suite of native-cloud features designed to revolutionize the way construction companies collaborate and win bids.

-

Sage 100 Contractor Release Update: What’s New in Version 26.1?

Sage 100 Contractor has recently released version 26.1, packed with enhancements based on your valuable feedback. Let’s take a closer look at what’s new!

-

Sage Intacct Construction August 2024 Release

One month into the Sage Intacct Construction August 2024 release, which new feature is your favorite? Not sure what’s new? Let’s explore some of the key highlights.

-

New Features Added to TimberScan Titanium 1.31

In this version, you will find several new features such as close accounting period, duplicate invoice validation, field set up and more!

-

Alta Vista Technology Announces Merger with Digitek Solutions

Onward and Upward! We’re looking forward to offer even greater value to our clients and create exciting opportunities for our employees.

-

Sage Field Operations New Features (Feb 2024)

Learn about new product capabilities in Sage Field Operations: Key Residential Workflows & Business Intelligence.

-

Office Closed for Team Building

We will be out of the office on Feb 23 – 26 for a team-building activity.Our team will be fully back in action on Tuesday, Feb 27.

-

Sage Intacct 2024 Release 1 Highlights

Coming Soon: Data Flow & Forms and Operational Flows. Boost organizational performance with seamless cross-functional workflows and data integration

-

New Features Added to TimberScan Titanium

Check out TimberScan Titanium release v1.30. New features for Sage 100 Contractor and Sage Intacct Construction user.

-

Sage 300 CRE Tips & Tricks

Compilation of helpful tips and tricks for Sage 300 CRE by The Users Group for Sage Construction and Real Estate Solutions.

-

Big News for Construction Estimators: Sage Acquires BidMatrix!

Get excited! Sage recently bought Bridgetown Software, the brains behind BidMatrix, a popular cloud-based tool for bid analysis.

-

Sage 300 CRE Year-End Training

In this complimentary training, we will cover the year-end process from start to finish, best practices, common pitfalls & frequently asked questions.

-

Sage 100 Contractor Year End Training

In this complimentary training, we will cover the year-end process from start to finish, best practices, common pitfalls & frequently asked questions.

-

Sage Intacct 2023 Release 4 Highlights

Advanced Ownership Consolidations – Bank Transaction Assistant – Project & Ministry Intelligence – Inventory Fulfillment – Construction Module Enhancements

-

5 Reasons Sage Intacct is the Right Choice for Construction Company

Discover why Sage Intacct outshines QuickBooks as the ideal financial management solution for your construction company.

-

8 Reasons Customers Choose Sage for Construction

48% of the ENR Top 400 Contractors and 53% of the BD+C Giants Top 115 Contractor firms choses Sage. Find out why.

-

Sage 300 CRE Tips & Tricks

Compilation of helpful tips and tricks for Sage 300 CRE by The Users Group for Sage Construction and Real Estate Solutions.

-

Time to Upgrade from Windows Server 2012 R2

Understand the risks to continue running business software on Windows Server 2012 R2 and the options to move forward.

-

Sage Intacct 2023 Release 3 Highlights

Sage Intacct 2023 Release 3 introduces new features: AP vendor approval, match tolerances for Purchasing, AR payment ID number sequencing, and construction vendor compliance.

-

TimberScan Tip Of The Month

Three ways to deal with multiple data entry users. Supporting Documents and the Support Document Inquiry are now available in TimberScan GO!