The first step to accelerating the close is finding the bottlenecks, whether they are the pains you’ve put up with or the hidden obstacles. At Sage Intacct’s annual Close the Books Survey, we asked 1,600 finance and accounting professionals about the obstacles with the largest impact during the close. We are excited to share these learnings with you as well as what some organizations are doing to build stronger finance foundations that enable them to close faster and grow their business.

1. Data manipulation in spreadsheets

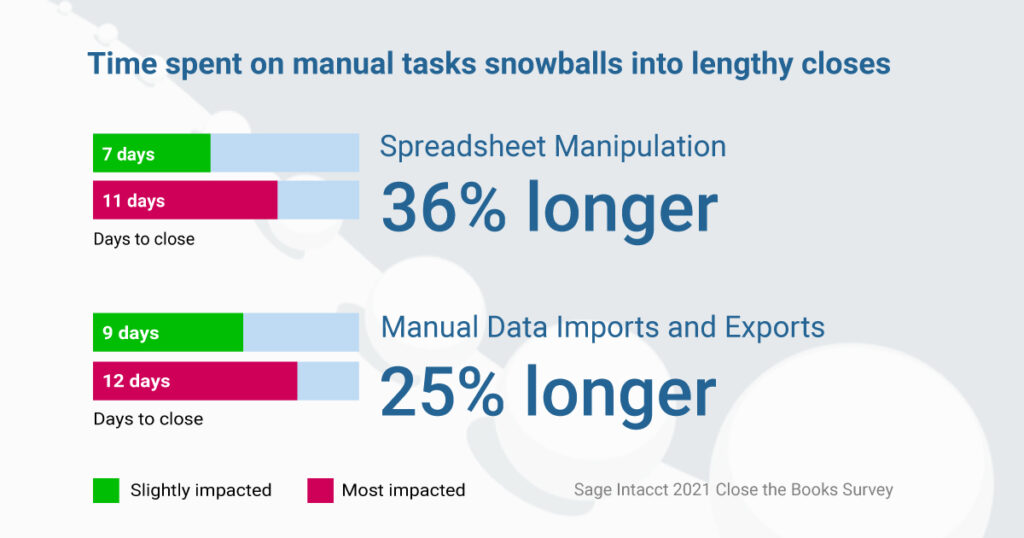

One of the biggest pain points of the close is data manipulation in spreadsheets. Relying on manual tabulations and moving data back and forth between spreadsheets and the accounting system slows down the close and can lead to businesses making decisions without the latest information as well as errors in their numbers. But just how much of an impact are these manual tasks making? Survey respondents who said they were most impacted by spreadsheet manipulation have closes that are 36% longer than those who are only slightly impacted. It’s no secret that manual work is painstaking and time-consuming.

The nonprofit, Pathway Lending, knows this first-hand. It provides loans and educational services for small business owners to help underserved communities in Tennessee and Alabama. CFO Barbara Harris and her accounting team had to manually manipulate data in Excel spreadsheets. It was cumbersome to capture and present the information needed to bill across 10 to 12 educational grants to the board of directors. Harris wanted an automated financial management solution with flexible, user-friendly reporting and a chart of accounts that could be divided into dimensions to reflect the organization’s business segments. They chose Sage Intacct, and after the switch, their customizable reports helped reduce the month-end close by 60% and provided better insights to board members faster with real-time information.

“Sage Intacct frees me up to be a better partner to the C-Suite. I’m able to get into analysis for strategic planning rather than just managing tactical financial processes because the team can handle those now without me. And that’s removed a tremendous burden for me,” said Harris.

2. Data imports and exports

Another major holdup in the close is the time spent importing and exporting manual data. In our survey, we found that organizations most impacted by manual data imports and exports have closes that are 25% longer than those that are only slightly impacted.

At the Archdiocese of Detroit, a nonprofit Catholic ministry responsible for hundreds of parishes in Michigan, the finance team was struggling to manage cash movement through manual journal entries. Their legacy accounting system made it difficult to track each of their revenue sources and related transactions as separate restricted and unrestricted funds based on each donor’s intent. The Archdiocese decided to move to a cloud-based financial management solution to streamline its accounting work.

“Prior to Sage Intacct, we spent approximately 85% of our time on bookkeeping and had only 15% free to analyze our data or do other special projects. Now that balance has changed, whereby we’re spending 65-70% of our effort on transactional tasks and about 30% on analytical work, despite increasing our workload with the same-sized team,” said Donald M. Genotti, Controller, Accounting & Treasury of the Archdiocese of Detroit.

With Sage Intacct, it deployed a new system and a greatly simplified chart of accounts that allowed it to track its operations and campaign activities for over a dozen entities. The finance team significantly simplified the process, exported transactions from its loan and deposit system each day, and imported them into Sage Intacct. This slashed their time spent supporting banking processes by about 25%.

3. Information hand-offs

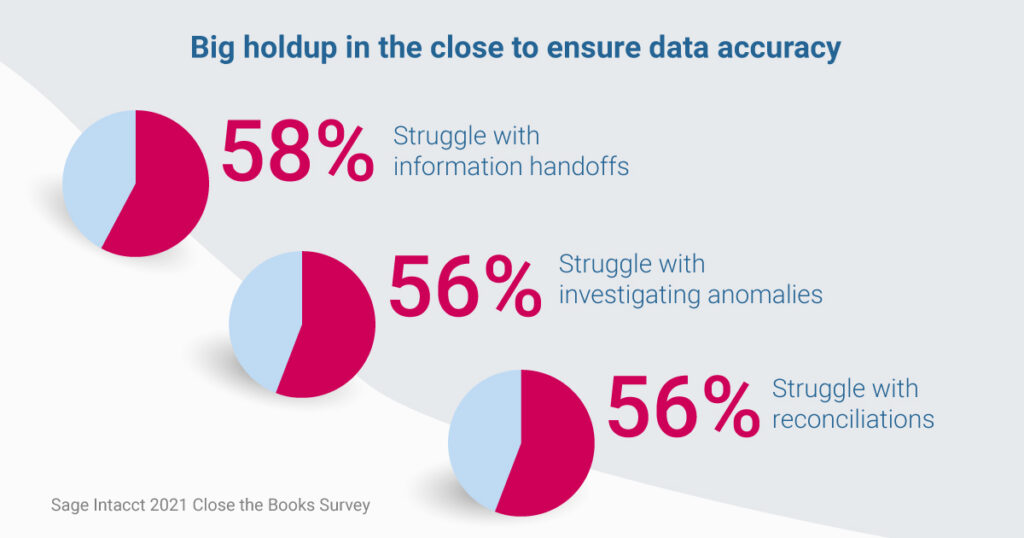

Survey respondents cited information handoffs as a cause of delays in the close. Data from across the organization is necessary to close the books each period. However, collecting the information can be challenging especially if the organization has teams or employees around the world. If someone on the finance team is closing the books and needs information from marketing, the back-and-forth emails could amount to one-to-two hours of effort and two to three days of elapsed time. In the survey, 58% of respondents said information handoffs have a medium to high impact on their close time. But when financials are run in well-connected cloud systems, there is no need for information handoffs as the data is available in real-time, giving accurate monitoring of business health–and of course an efficient close.

Halstatt, a family-owned investment firm that specializes in real estate, private equity, and other initiatives, can easily share data across the natively integrated Sage Intacct solution and better collaborate with stakeholders. “It saves us many, many hours because we don’t have to have meetings and send multiple emails back and forth with different budget versions. We could probably do budgets in a week, instead of a month,” said Amanda Goebel, senior accountant at Halstatt. With Sage Intacct, Halstatt strengthened collaboration across the business and empowered the finance and accounting teams to be strategic partners.

4. Investigating anomalies

Another big holdup in the close is ensuring data accuracy. Just like reconciliations, 56% of respondents said investigating anomalies has a medium to high impact. A modern cloud financial management system with anomaly detection helps spot inconsistencies and frees up time for finance teams to spend on higher-value activities like analysis and strategic planning. It also ensures numbers are accurate across the entire span of a financial period. Sage Intacct helps businesses easily crunch through and analyze vast quantities of data, zero in on anomalies, make recommendations, and take action.

It helped Canadian independent music record label Monstercat gain visibility across the business as it grew and added more entities and currencies. “I especially love the Sage Intacct dashboards and use mine all the time. It has our monthly P&L broken out into the account types I want to see at a glance, so I always have a good idea of how the company’s doing and can quickly spot trends or anomalies in our expenditures or monthly revenue,” said Monstercat Director of Finance Rob Hill.

Monstercat needed a better way to manage and report on its dynamic revenue streams as they turned their passion for electronic dance music and knack for monetizing it via YouTube into a community-based approach to promotion and distribution. “We were getting to the point where the [on-premises] tools we had to track our financials were just not going to be sufficient,” remembers Hill. As a result of making the switch to Sage Intacct, Monstercat saved days of monthly report preparation and increased finance team productivity by 30%.

5. Reconciliations

Respondents identified data accuracy as another bottleneck of the close. When asked to what degree reconciliations impact close time, 56% of respondents indicated it has a medium to high impact. But the reconciliation process doesn’t have to be painful. Top performing organizations speed up their close without sacrificing efficiency with automated reconciliations. This feature automates transaction matching and reconciliations daily to ensure cash accounts are tied to bank accounts, speeding up month-end closes.

Anchor Loans, a “fix and flip” construction lender, solved its “nightmare” of manual reconciliations with Sage Intacct. Within a few months of implementation and migration, Anchor Loans was using Sage Intacct automation to eliminate up to 16 hours a month of manual bank reconciliations that the finance team previously did in Excel. They also optimized the balance sheet reconciliation process from 12 business days a month to just 3–a 75% improvement. Automation makes it easy for accountants to spot reconciliation discrepancies and drill down into details for resolution.

“Sage Intacct empowers my team to provide information to management that helps us make better, more informed decisions, placing us in a better position to more effectively serve our customers and stakeholders. I couldn’t possibly be happier with Sage Intacct, and we haven’t yet scratched the surface of what it can do,” said Bryan Thompson, Anchor Loans CFO.

In conclusion

Finance leaders with teams that can accelerate past the major slowdowns of the close have access to reliable information sooner. They use that data to make real-time strategic business decisions and future forecasts and become greater assets in their organizations.

“Long, onerous close processes not only dampen team morale, but impede an organization’s decision-making when it can’t get current, accurate information at critical times. Having the right technology in place enables finance and accounting teams to speed the close and gain faster insights as they evolve from being historians to visionary business leaders,” said Dan Miller, Sage EVP of Medium Segment (interim).

This post originally appeared on Sage.com