Why should I choose Sage Intacct Fixed Assets, over continuing to manage my fixed assets in spreadsheets?

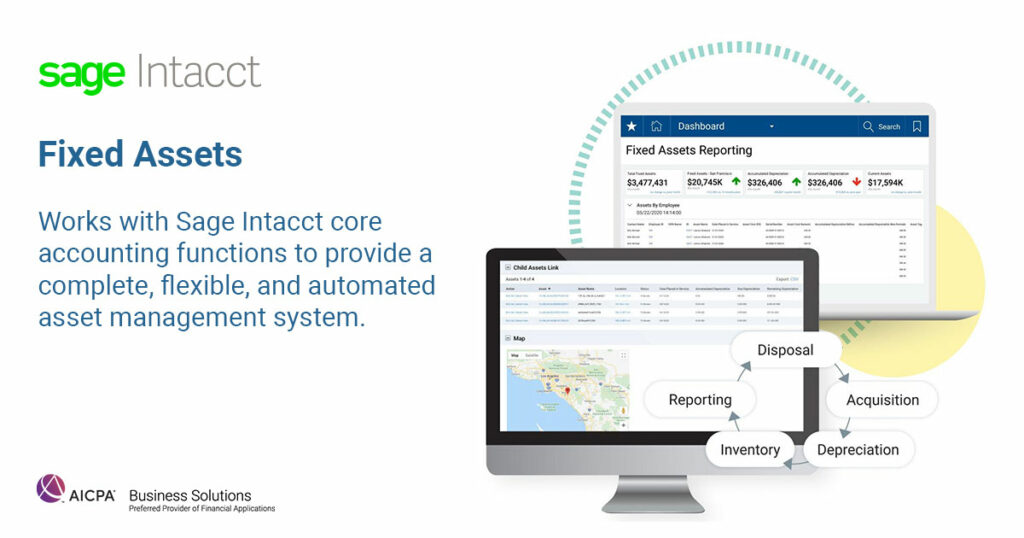

The lack of automation, visibility, and controls in spreadsheets can lead to inaccurate depreciation schedules in calculations, assets not being disposed of on time, and the creation of ghost or missing assets. Together these factors can adversely affect your bottom line and expose you to risk. Sage Intacct delivers automation from acquisition to disposal, provides complete control over the asset lifecycle, and serves up insights to make better decisions—enabling you to:

- Know the status of every asset in real-time.

- Eliminate overpayments on insurance, income, and property taxes.

- Save significant amounts of time spent rekeying data, calculating depreciation, and building reports.

- Simplify compliance with IRS guidelines.

I’m spending too much time on manual processes. How can Sage Intacct Fixed Assets help me?

If you’re like most organizations, managing the volume of data that needs to be tracked through an asset’s useful life in spreadsheets or a siloed fixed asset solution creates hours of manual work. By unifying fixed asset management with core financials, Sage Intacct is able to deliver automation from acquisition to disposal and eliminate duplicate data entry. This enables you to:

- Accurately capture all assets by generating the asset master as they post to Sage Intacct Purchasing or Accounts Payable solutions.

- Automate recurring journal entries and financial and tax depreciation calculations with predefine or user-configured depreciation methods.

- Shave hours off the disposal process and increase depreciation accuracy with partial and mass disposal of assets.

- Create gain or loss, depreciation, and disposal journal entries automatically, while partially disposing of an asset.

- Spend up to 50% less time on year-end processes.

My fixed asset data lives in multiple systems or spreadsheets, and I’m worried about the lack of control over my data. How can Sage Intacct Fixed Assets help with that?

Sage Intacct enables you to take back control over your data and processes, while reducing risk, and slash monthly close cycles by:

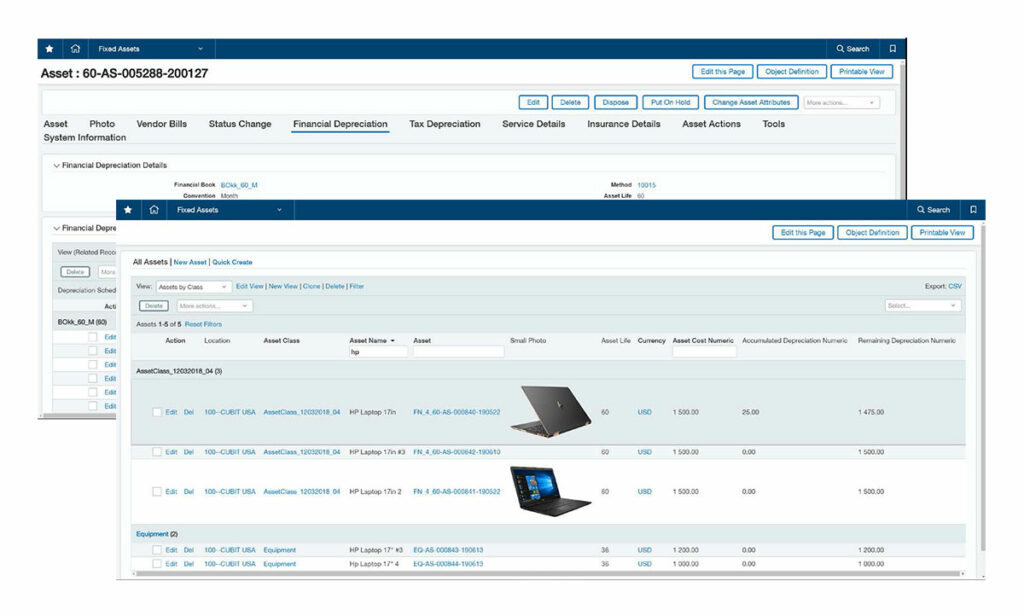

- Centralizing asset management. Manage and safeguard your central asset register, which includes multi-currency and multi-location, for depreciating and non-depreciating assets.

- Enabling you to track and report on asset information including condition, warranty, dates serviced, and insurance status.

- Ensuring accuracy and accountability whenever changes are made, with complete audit trails.

- Automatically generating schedules when you change an asset’s cost or useful life.

- Providing you the peace of mind that your data is always secure and accessible, thanks to world-class security, cloud backups, and disaster recovery.

With control over your processes, visibility into your assets, and clear audit trails, you can slash even more time off your monthly close cycles.

I’m having difficulty tracking and getting visibility into the information I need to adequately manage my fixed assets. How does Sage Intacct support that?

By unifying fixed asset management and core financials, Sage Intacct gives you access to the real-time data you need while enabling you to report across solutions. Access to real-time data enables you to:

See the complete lifecycle of an asset by drilling down into the asset record directly from general ledger transactions.

- Discover how costs are distributed by location, department, project, and more, with dimensional tagging.

- Reconcile net book values in minutes with a single view of accumulated depreciation, additions, and disposals across your business.

- View physical asset locations using a map interface.

How have other companies benefitted from switching to Sage Intacct?

Bay County Medical Care Facility (BCMCF) is a government owned and operated skilled nursing facility that provides critical skilled nursing services for the community’s aging residents. They faced the challenge of using a mix of outsourced accounting services, legacy on-premises back office systems, and Excel spreadsheets to manage financials. When they decided to bring on an in-house staff accountant, she was mired in manual processes that left her only able to spend 20% of her time on producing financial statements for the board. After deciding to make the move to Sage Intacct, BCMCF was able to:

- Prepare its first ever facility-wide fixed asset inventory

- Improve reporting accuracy by 70%

- Slash their monthly close cycle by 90%

- Increase gross margin by 50%