Biotech and life sciences companies are at the forefront of science, but their finance teams frequently use outdated tools and processes. This is not ideal when key stakeholders, including private equity partners, stockholders, and venture capital investors, require customized financial information.

Sage Intacct and Gatepoint Research surveyed 100 finance executives in the biotech and life sciences industries to determine how their teams prioritize these needs, what challenges they face, and how they use technology to elevate finance’s role in the business.

Small teams, big agenda

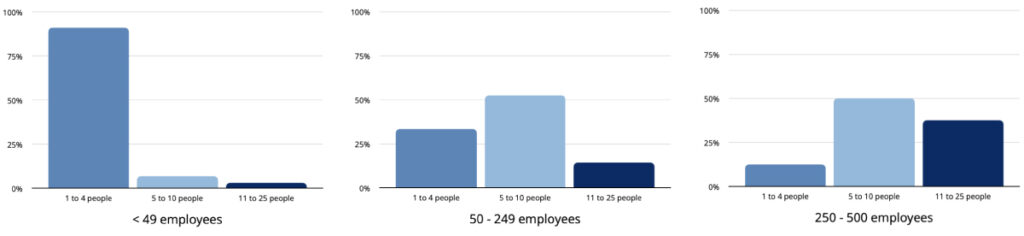

Most companies surveyed are pre-revenue therapeutics start-ups with fewer than 10 to 500 employees. Half of the executives surveyed have less than four people on their finance team. Even companies with 250 to 500 employees say that their average team size is in the single digits.

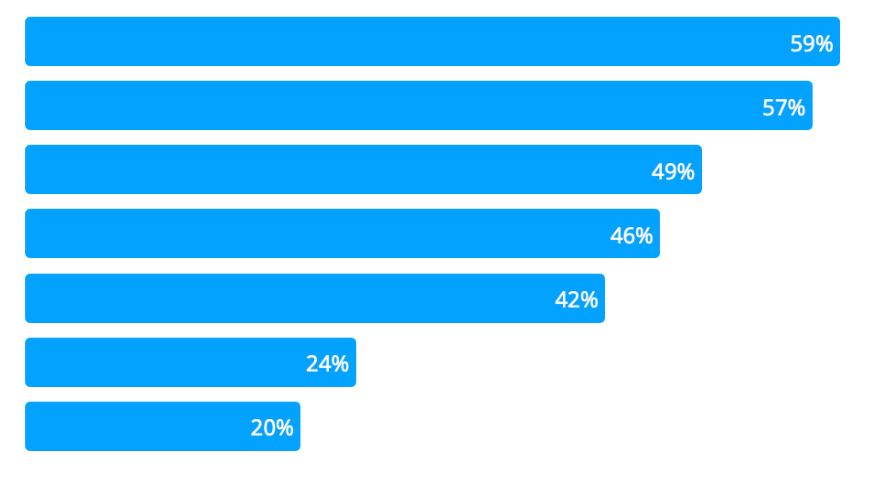

Those small teams, however, are tasked with several initiatives, including:

- 59% Gaining operational efficiencies by simplifying processes

- 57% Automating manual processes

- 49% Building data analysis capabilities and skills

- 46% Optimizing the finance operation model

- 42% Harnessing data to meet changing information needs of stakeholders

Poor integration and manual tasks hold finance teams back

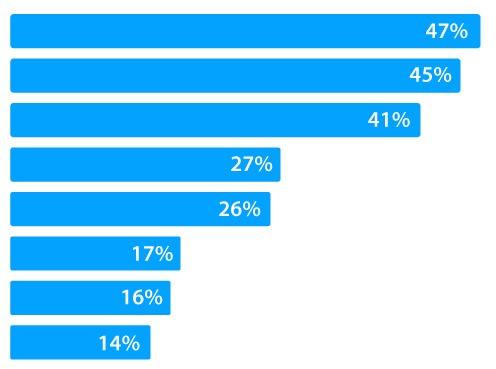

The fact that nearly 60% of finance leaders report that their current processes are challenging is not surprising. With most funding going to biotech R&D, finance is often stuck with rudimentary bookkeeping, which means lots of spreadsheets. The problem with spreadsheets and manual data is that it takes a long time to gather, it’s prone to errors, and it’s hard to analyze.

It also introduces other challenges, including:

- 47% Poor integration of data from different systems

- 45% Cumbersome administrative and manual tasks

- 41% Budget constraints for finance technology

- 27% Lack of relevant skills within the finance team

- 26% Inadequate or outdated finance systems

- 17% Changes to compliance requirements

- 16% Leadership reluctance to change the status quo

- 14% Perceived risk of migrating business-critical systems

How finance adds value

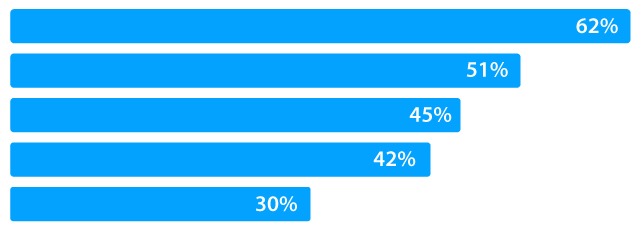

Finance leaders recognize the importance of data analysis to drive strategic decision-making for their businesses: the majority of the executives surveyed said building data analysis capabilities and skills is a significant initiative.

- 62% Key metrics monitoring dashboards

- 51% Create and customize relational reports

- 45% Automate cumbersome tasks

- 42% Real time financial data

- 30% Better integration with existing tech stack

The data clearly shows strategic initiatives rather than tactical ones and suggests a fundamental shift in how the finance function operates within the business. This shift has been underway for years and finance leaders are looking to advanced analytics to help them add value in strategic areas of their business.

Advanced analytics in planning, risk management, and operational decision-making

COVID-19 has changed how finance leaders think about using data to manage risk. Scenario modeling and planning are helpful even when there isn’t a global pandemic. But they are equally helpful in preparing for other market fluctuations or funding rounds.

| Extensive use of advanced analytics in… | Today | In the next few years |

|---|---|---|

| Planning, Budgeting, Forecasting | 25% | 43% |

| Risk Management | 3% | 22% |

| Operational Decision-making | 17% | 40% |

By putting finance at the center of all business systems, finance teams can see all of their key metrics on one dashboard and know where they stand in real-time. That also makes it easier for them to report their numbers to stakeholders and investors.

Summary

Overall, the small finance teams of Biotech companies often struggle to navigate different priorities, serving a plethora of stakeholders. The biggest obstacle to innovation is manual tasks and outdated processes.

Those same tasks are holding them back from changing their modus operandi. Add in the challenge of integrating their finance system with various other systems and limited budgets; driving change can be difficult.

Yet, it is the change in technology that enables more efficient processes, helping to elevate the value finance can add to their business. By using modern finance technology, finance teams can gain unprecedented real-time insights, and automated processes free up time to analyze data to help inform strategic decisions.

The survey audience recognizes this shift and the need to act: 95% of finance executives surveyed plan to re-evaluate their financial management system in the next 12 months.

This post was originally published on Sage.com