Arts, culture, and humanities nonprofit organizations play an important role in our communities. Whether your organization is a museum, art school, historical society, performing arts center, media & communications organization, or other culture-focused nonprofit, you face unique issues from managing ticket sales and donations to safeguarding assets and endowment portfolios. To meet these accounting, tracking, and reporting needs, you need specialized functionality in your financial systems to help you accomplish your mission.

However, you can’t fuel your growth and need for accountability and transparency by simply automating the minimum. That’s why more arts and culture nonprofits are replacing inflexible, inefficient, and outdated software with a new breed of modern cloud solutions. These organizations are modernizing their financial operations using four creative strategies to address the serious barriers to success they are facing.

In a recent survey conducted by Sage Intacct, finance leaders within nonprofits shared their top five obstacles:

- Lack of process automation and organizational efficiency

- Inefficiencies and delays due to multiple, disparate systems

- Manual, time-consuming reporting

- Lack of real-time visibility into key metrics and performance

- Inability to measure outcome metrics

This article will examine how arts and culture nonprofit organizations like yours can leverage cloud accounting software to modernize finance and empower your modern accounting team. Here are four creative ways your nonprofit can use Sage Intacct nonprofit accounting software to deliver better mission impact:

1. Empower your people to work from anywhere and slash IT costs

Older on-premises accounting systems are often expensive to own and lack the functionality needed for your nonprofit to meet its goals. Nonprofits pay too much for features they don’t use, and the solution is often inflexible and inefficient. By replacing an outdated system with cloud accounting software, organizations only pay for what they use. Plus, some solutions are designed to meet the unique needs of arts and culture nonprofits while remaining easy to use. Affordability improves since there is no IT infrastructure to maintain.

For 25 years, WMHT Public Media used an on-premises accounting system. However, over the years, WMHT experienced increased fund and project accounting complexity and realized it was time to bring their system into the 21st century. WMHT replaced their outdated system with Sage Intacct. Now, WMHT’s leaders have valuable real-time performance snapshots at their fingertips, making their team more effective and efficient.

Being able to work from home (or anywhere) is an important benefit of cloud accounting software. With solutions like Sage Intacct, arts and culture nonprofit finance teams can shift seamlessly from working at the office to working at home or any other location—while maintaining peace of mind their data is safe and secure in the cloud.

2. Deliver insight that inspires and emboldens

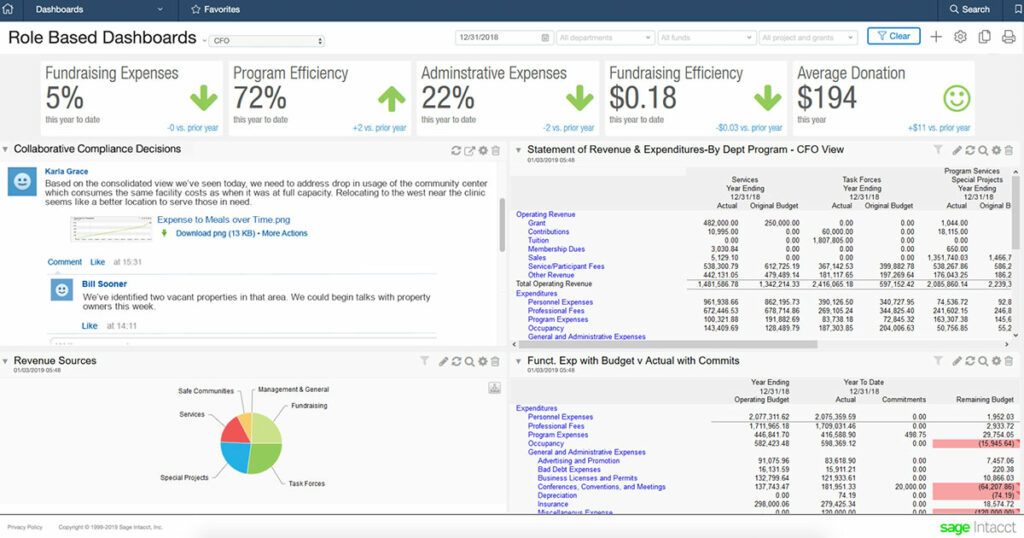

Arts and culture nonprofits need real-time visibility into every aspect of their finances, whether that’s seeing what funds were used for each program, analyzing by location, or viewing expenses tied to each volunteer or employee. Using modern cloud financial solutions like Sage Intacct, arts and culture organizations gain immediate visibility into financial data with easy-to-use, real-time financial and operational reporting and dashboards.

Role-based dashboards and analytics make it easy to keep a pulse on the health of the entire organization as well as individual programs—plus accurately budget for the months ahead. This support allows nonprofit finance teams to become more strategic and forward-looking. The access to real-time information provided by Sage Intacct enabled WHMT Public Media to increase grant funding.

3. Infuse flexibility and automation into financial processes

Cloud financial management solutions bring flexibility and automation to operational workflow processes. Designed to evolve with your organization, Sage Intacct’s flexible and configurable architecture can be adapted to support the tracking, electronic approvals, and workflow requirements needed by the organization to best support the mission and improve operational efficiency.

From ground zero, GRAMMY Museum Mississippi used Sage Intacct to establish every business process it needed, building a modern, audit-ready foundation upon which to scale. As the nonprofit quadrupled grant funding and program reach, its finance team was ready to rock and roll thanks to the benefit of automation.

4. Maintain artistic freedom and integrate best-in-class solutions

When you’re busy promoting appreciation and enjoyment of arts and culture, you strive to showcase the best. Likewise, nonprofit finance teams should also be free to utilize the best apps and technology. Sage Intacct empowers nonprofits to strengthen their organizations with seamless integration to the best third-party business applications.

Sage Intacct partners with more than 200 software solution providers using open API and true cloud integration strategy. This ensures that the finance team delivers plenty of meaningful insights for the management team by harnessing technology to work smarter.

For example, Yerba Buena Center for the Arts (YBCA) uses Sage Intacct to improve efficiency, budget accuracy, and save on personnel costs. YBCA also benefits from the flexibility Sage Intacct provides when integrating with other specialized applications.

Conclusion

There are many creative ways arts and culture nonprofits can use cloud accounting software to modernize finance. From empowering accounting teams with anytime, anywhere access to delivering immediate visibility with role-based dashboards, infusing flexibility and automation into financial processes, and seamlessly integrating with third-party business applications.

This post was originally published on Sage.com