It’s that time of the year again – 1099 season is upon us and it’s time to begin preparing your vendors and reconciling your 1099 report. We have compiled some best practices and helpful tips to make your year-end process easy.

Prepare in Advance

- Run 1099 reports regularly throughout the year

- Create all reports and views needed

- Perform monthly vendor and bill audits to confirm 1099 selections are accurate

- Make updates to bills / vendors that month to avoid mass updates or reclassification

- Review vendor 1099 contacts

- Purchase forms in advance from our Checks & Supplies Center on the Sage Intacct home page

- Set up the necessary location groups for printing when there are shared Federal IDs

- Utilize checklists to ensure all 1099 duties are completed throughout the year and during 1099 season

Quick Tips

- Create custom vendor list views to validate the vendor 1099 names and vendor 1099 forms prior to printing.

- Perform “trial prints” to confirm print alignment once the year is available on the Form 1099 page. This prevents any wasting of 1099 forms when printing your entire vendor 1099 form list.

- Don’t forget to change the year on the Form 1099 page prior to printing.

- When adding 1099 values to a vendor record manually, it is imperative you select the correct 1099 year to prevent inaccuracies on the form/report.

- When manually changing the vendor’s 1099 amount, a positive value in an empty 1099 box will increase the vendor’s 1099 amount while a negative value will decrease the amount. If there is already a value in the box, increase or decrease that existing value to modify the amount currently printing on the form.

- 1099 amounts will show in the year the bill is paid, not the year the bill was created in.

- When printing the forms, be sure you are using Adobe Reader rather than your in-browser PDF viewer. Additionally, set “Page Scaling” to none and uncheck the option “Auto Rotate.”

- If the vendor’s 1099 amount is LESS than $600, it will not print a 1099 form.

- In order to reclassify the 1099 flag on an AP Bill, the bill must be partially or fully paid.

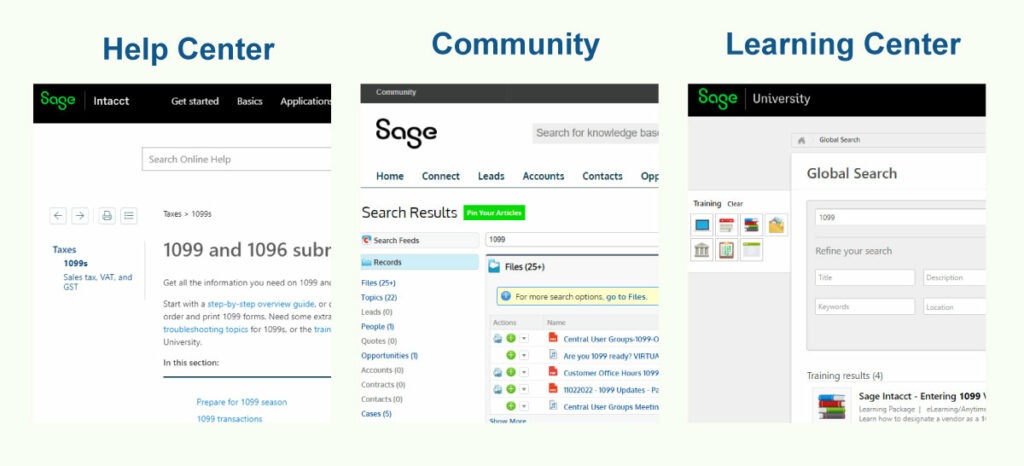

For Additional 1099 Resources

- Search the Sage Intacct Help Center. It provides multiple 1099 how-to and troubleshooting topics

- Read 1099 FAQs and Articles in the Sage Intacct Community

- Watch 1099 Courses in the Sage University (previously known as Learning Center)

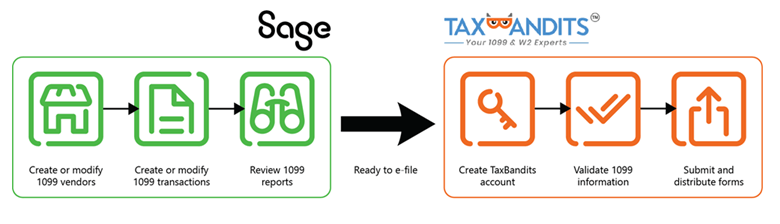

1099 E-filing Powered by TaxBandits

Tax law requires you to file tax forms electronically if you have more than 250 vendors that require a 1099 form. You can use Sage Intacct trusted marketplace partner TaxBandits, without having to export files or manipulate spreadsheet data. Our seamless integration allows you to share 1099 data with a click of a button, then continue to the TaxBandits site to file the forms.