Sage Intacct’s first release of 2023 is packed with new features and enhancements that streamline your financial procedures and improve your daily operations.

- AP automation is now available to US customers!

- Filter available credits in Pay Bills

- View and manage Vendor information efficiently

- Creation rules now support VAT and GST transactions

Industry functionality includes:

- Construction payroll: get accurate visibility into labor costs for higher profitability

- Project-based businesses: more flexibility for managing projects

- Usage billing for evergreen subscriptions

- Dioceses savings and loans: streamline transaction processing and improve reporting insights

Financial Features:

Accounts Payable Bill Automation

Just upload your bills or email them to Sage Intacct. The system will automatically generate draft bills using AI and machine learning, which you may examine and edit before submitting for approval. Then, easily pay your suppliers and vendors using electronic payments.

With AP automation, Intacct customers are saying they can process invoices up to 50% faster resulting in huge time savings. Reach out to us to get started and to learn about current promotions.

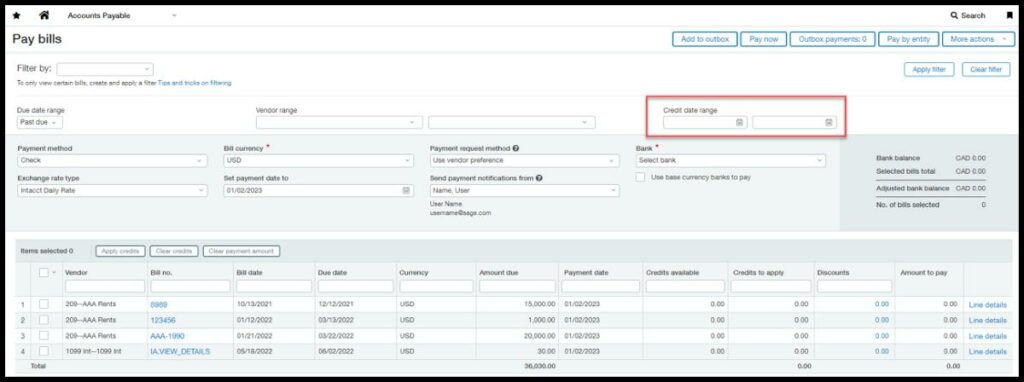

Filter Available Credits in Pay Bills

Increase your efficiency when paying bills and apply just the credits you want. You can now quickly view available credits created within a date range using the new filter on the Pay Bills page. For example, you can exclude credits created before, after, or matching the dates of the AP bills in the selection. This flexibility saves you time by reducing the need to drill into the details to individually exclude specific credits.

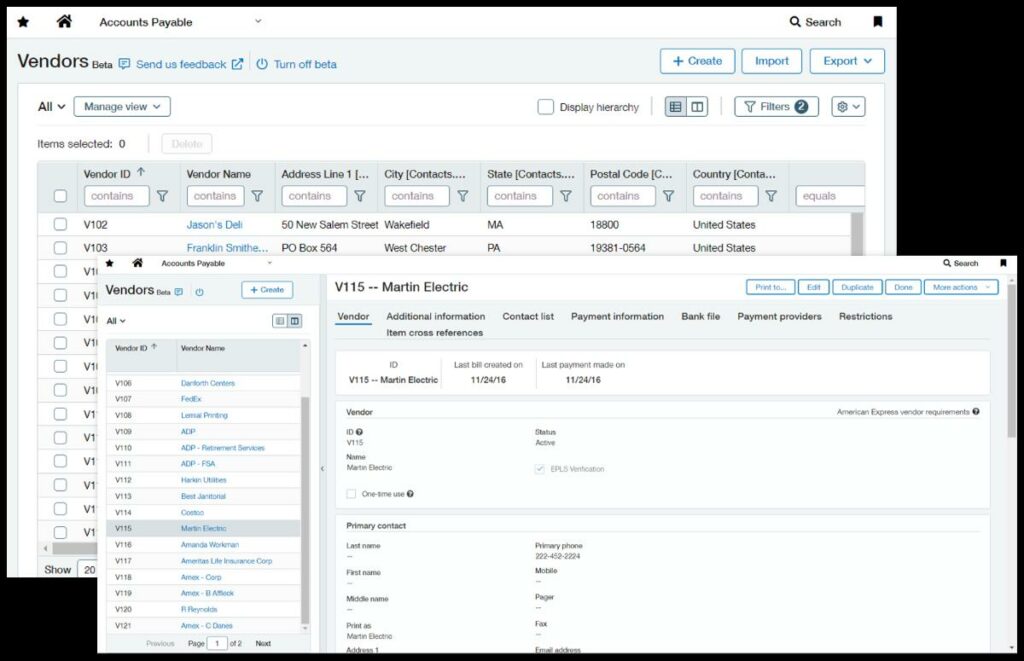

View and Manage Vendor Information Efficiently

From the Vendor List screen, click on the link to turn on the list beta interface which allows you to:

- Personalize list views on the fly—add, remove reorder, resize, and freeze columns with drag and drop interactions.

- View precisely what you need to see with advanced filtering and sorting. You can even save what you filter into a custom view for repeated use.

- Compare records details side by side using a split view mode.

- Batch operations such as bulk delete.

- Improved organization and central management of list views

- More colors for displaying your hierarchy

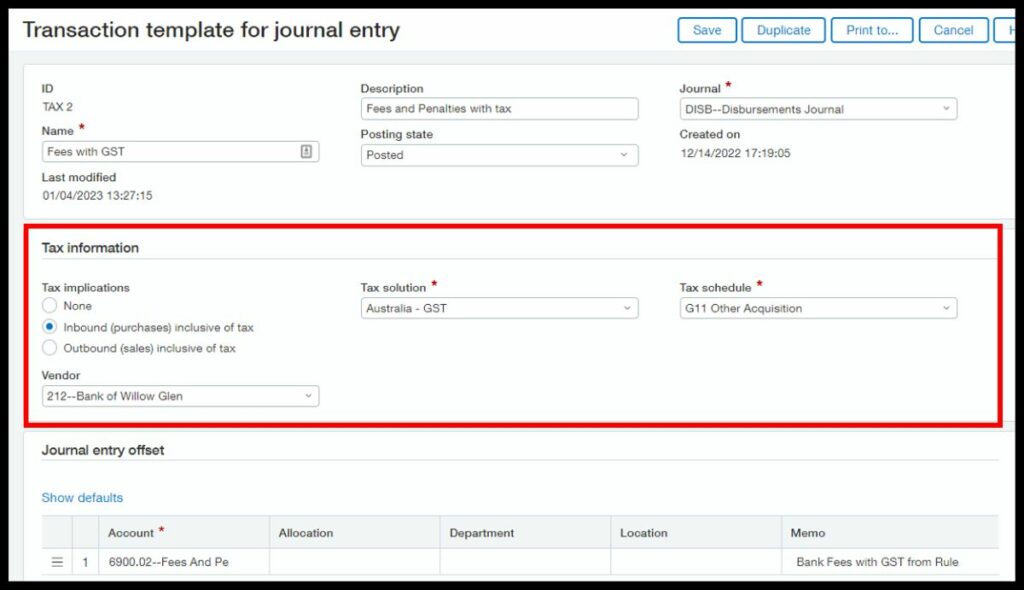

Creation Rules Now Support VAT and GST Transactions

Using creation rules to add VAT and GST tax to journal entries and credit card transactions, you will save time during reconciliation and reduce the potential for errors. Tax calculations are accurately recorded using tax details assigned to a tax schedule, and generated transactions are inclusive of tax.

Entering tax details on a creation rule transaction template is effortless, and a creation rule will always use the latest tax details assigned to the given tax schedule.

Industry Functionality:

Construction and Real Estate

This release includes significant enhancements for construction customers.

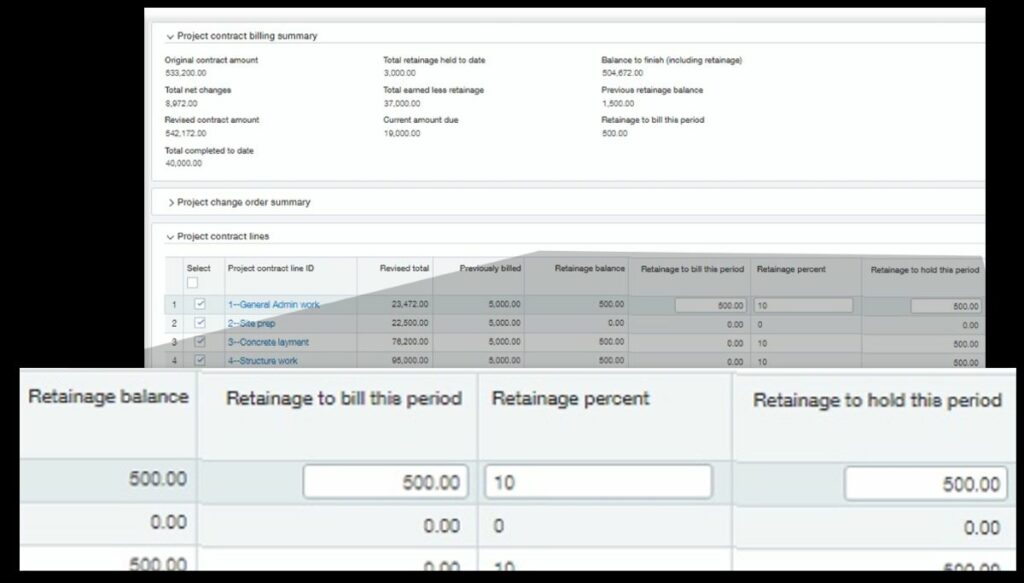

Project contracts & billing enhancements include:

- The ability to release retainage as part of the project generate invoice workflow

- Improved visibility into related invoices, retainage releases, and payments from the project contracts screen

- The ability to create one or more GL budgets for project contracts and reflect your GL budget entries on your financial reports.

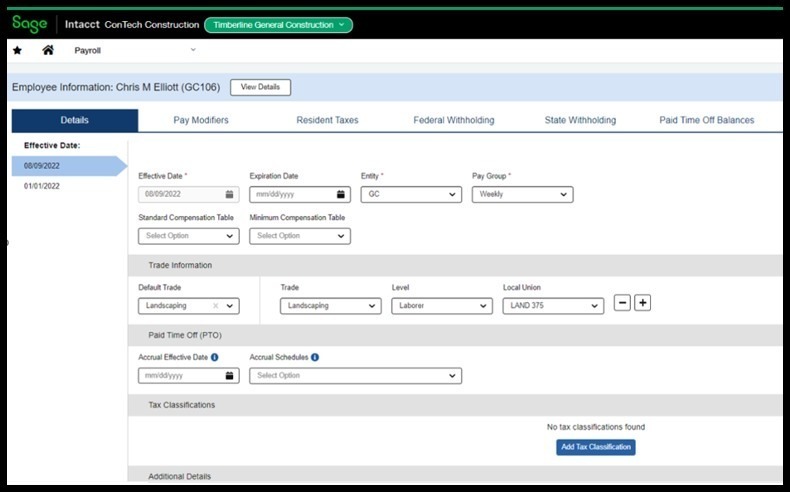

Construction payroll enhancements include:

- Optimized payroll menus and navigation for better usability

- Expanded custom reporting capabilities to produce payroll check, gross pay, pay modifier, PTO activity, tax, and timecard reports

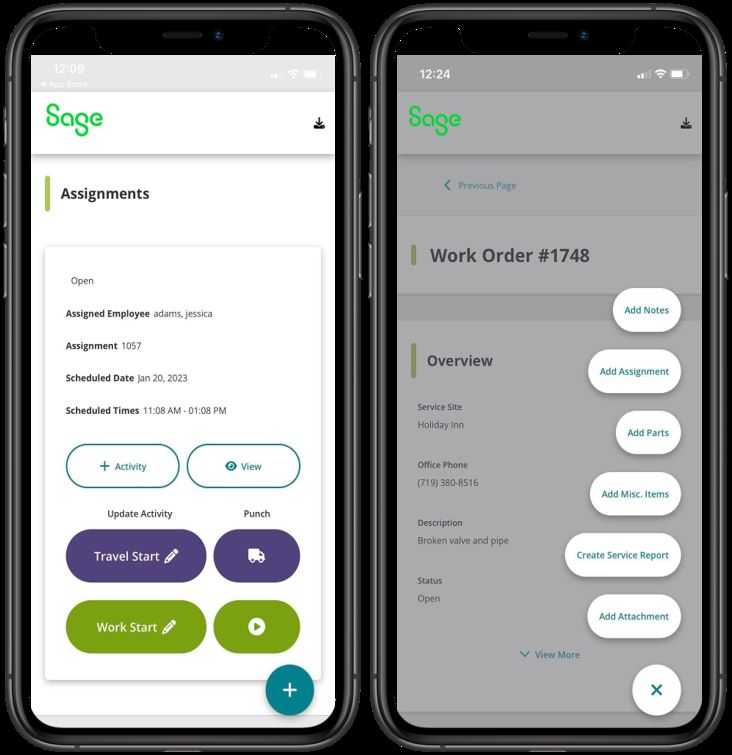

The Service and field operations module enhancements include:

- A brand new mobile app that is optimized for HVAC, electrical, and other self-performing contractors with field employees.

- Improved work order and project integration for improved tracking and visibility

- Additional reporting for Agreements and technician profitability.

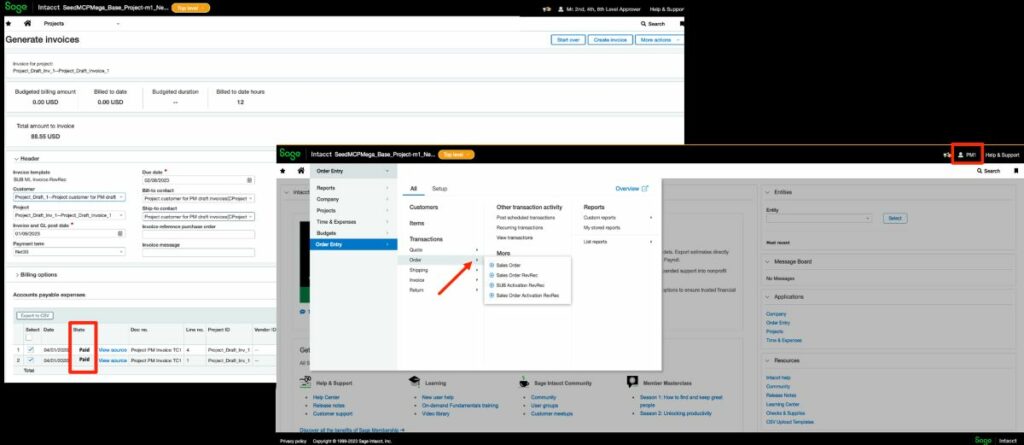

Project Based Businesses

For customers who leverage Sage Intacct Projects Module, now you can

- Use the state of source transactions to decide which transactions to include. For example, you can decide to only include paid AP bills when generating project invoices.

- Enable project managers to produce quotes and orders in the order entry module if appropriate for how your organization works.

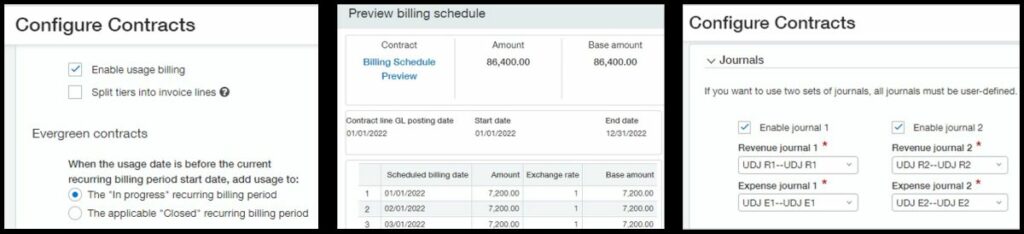

Subscription Based Businesses

This release includes several enhancements that increase the flexibility and usability of subscription contracts.

- Usage charges can now be included in your open-ended evergreen subscription contracts. You have the option to include usage in the current or previous billing period.

- A billing schedule preview has been added so you can see the result of billing option changes before you save, increasing confidence that you are making the right updates.

- And more configuration guidance and validations have been added to help ensure your setup follows best practices so you get the desired visibility and reporting.

Faith-Based Non-Profit Organizations

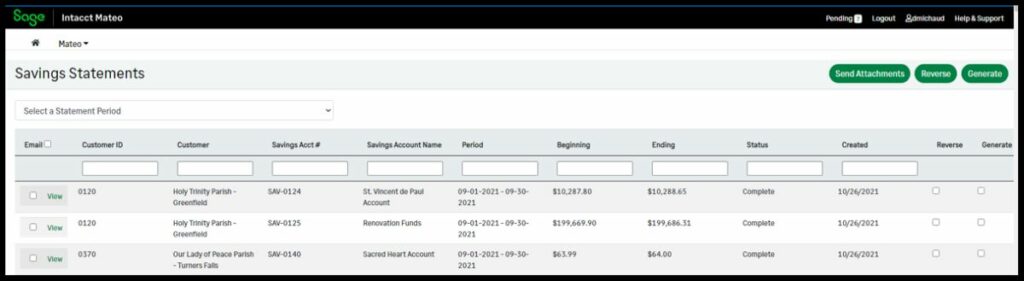

2023 Release 1 includes several enhancements to Sage Intacct Mateo, a solution for faith-based non-profit organizations to effectively and efficiently manage their savings and loan programs with simplified transaction processing and improved reporting insights.

- Improved flexibility to generate interest and statements when you want as well as reverse interest and statements on individual savings and loan accounts.

- Streamlined workflow to close a savings account and distribute the account balance in one step.

- And expanded import capabilities including support for more types of data and flexible posting options.

Watch the release notes video to get a quick understanding of the release highlights. In addition, you can take a deeper dive here.