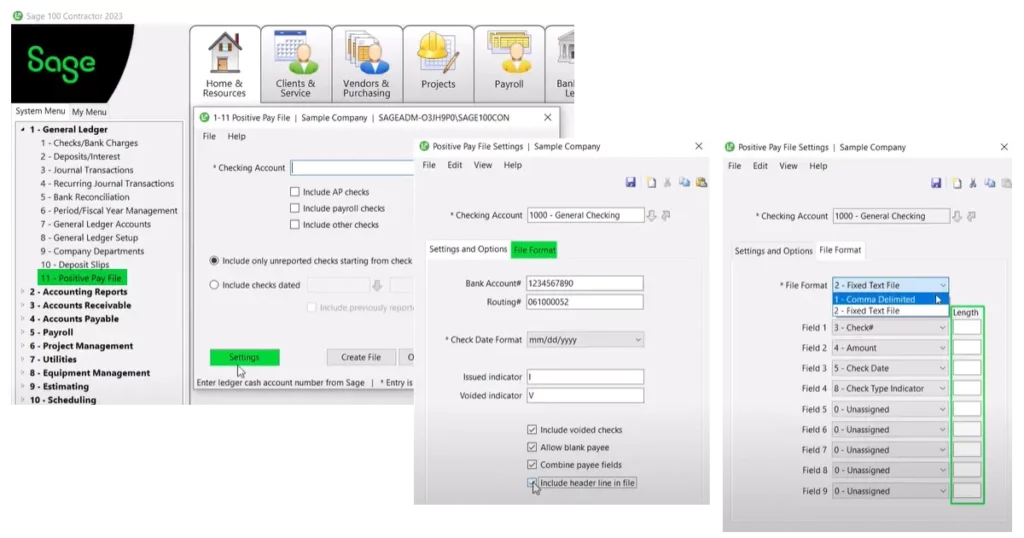

Sage has incorporated the top-ranked suggestions from the Sage 100 Contractor Ideas site into the version 25.1 release related to General Ledger and Accounts Payable Modules. The enhancements include the positive pay file, new PO# and Subcontractor# fields, edit posted credit card transactions, import credit card transactions, and credit card reconciliation.

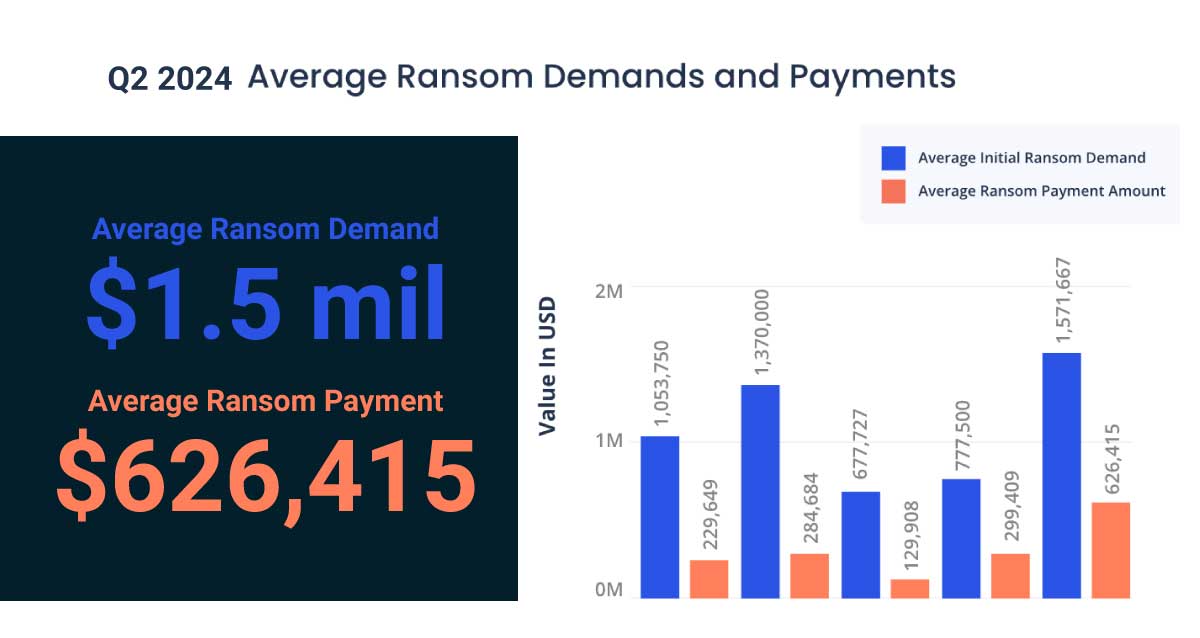

Positive pay offers protection against fraud

Positive pay is a service your bank may offer to help guard your company against fraud. If you pay your vendors and employees by check, you can submit a file containing the details of those payments to your bank. This file is the positive pay file.

When someone presents a check drawn on your bank account, the bank compares the information in the positive pay file with the paper check. If there are any inconsistencies, the bank can alert you.

Edit posted credit card transactions

- In the 1-3 Journal Transactions window, you can unlock and edit credit card transactions if they have no vendor.

- In the 4-7-5 Reconcile Credit Card Accounts, if you have Company Admin rights, when you drill down to a credit card receipt using the [Go to Transaction] button, if the receipt has a vendor, you can choose to view and edit the AP invoice.

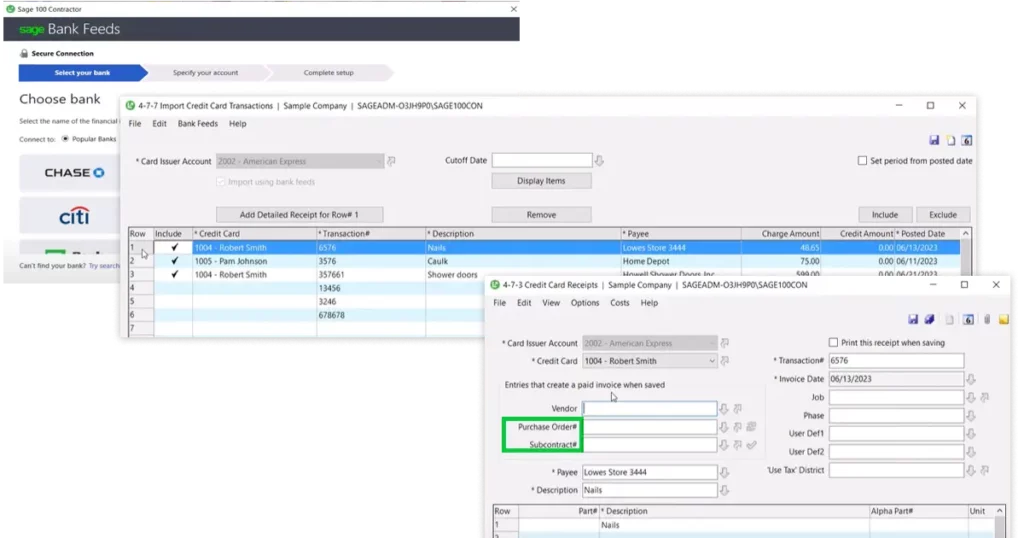

New Purchase Order# and Subcontract# fields

In the 4-7-3 Credit Card Receipts window, you can use the new Purchase Order# and Subcontract# fields to apply payments to a subcontract or purchase order. You can also set options to warn you if the invoice you are paying exceeds the tolerances set for subcontracts or purchase orders, similar to the warnings in the 4-2 Payable Invoices/Credits window.

Importing credit card transactions

In the new 4-7-7 Import Credit Card Transactions window, you can use Sage Bank Feeds to download credit card transactions automatically to Sage 100 Contractor.

You can also download credit card transactions directly from your bank to an Excel or CSV file, edit the data, and then copy the transactions to the grid, or you can type the transactions into the grid.

Important! Bank Feeds can connect to one credit card account per card issuer (bank). If you have more than one credit card, you need to create separate card issuer accounts for each credit card number so that you can import and reconcile transactions for all the credit cards.

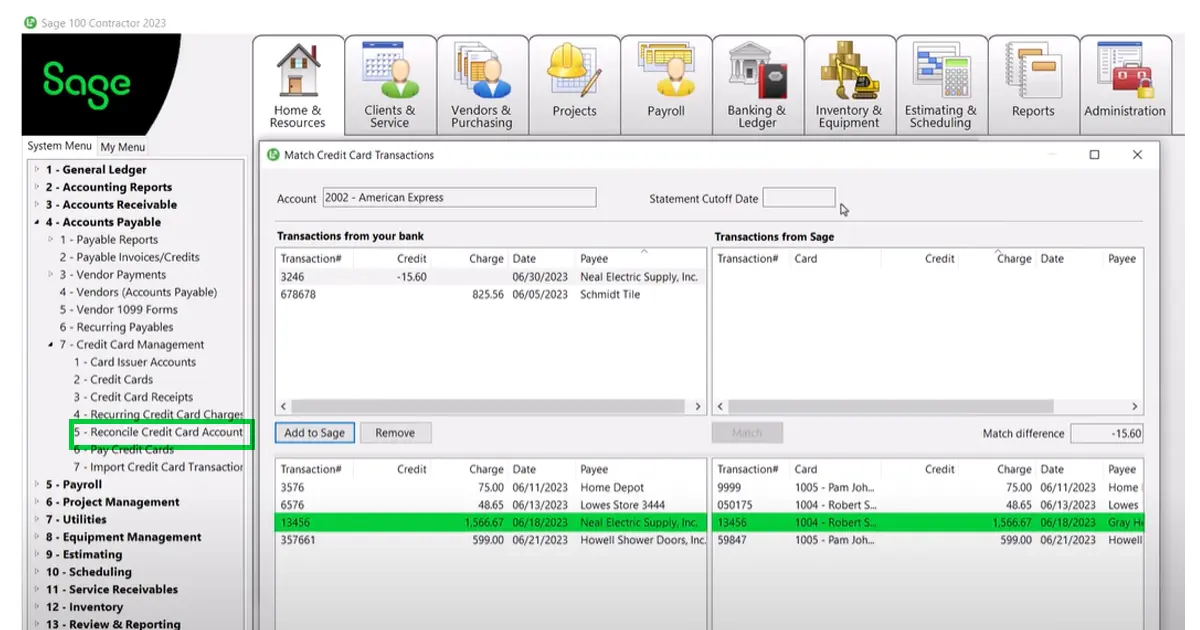

Reconciling downloaded credit card transactions

In the new 4-7-5 Reconcile Credit Card Accounts window, you can use Sage Bank Feeds to connect your card issuer account to the issuing financial institution, and then automatically download and reconcile credit card transactions.

Sage 100 Contractor will attempts to match the transactions automatically for you if they:

- Are unique. (Very similar or duplicate transactions in your system cannot be matched automatically.)

- Have the same payee and amount.

- Are dated earlier than the corresponding bank transaction.

For a complete list of all enhancements and fixes, read version 25.1 Release Notes. You can also watch this YouTube video. Thank you for your product ideas.