Closing the books is a source of frustration for many construction firms. The construction industry is not alone – “the close” can be a pain point for businesses across a variety of industries. Sage Intacct conducted the annual “Close the Books” survey to see what’s working, what’s not, and what the future holds when it comes to the close. Taking a closer look at the findings can give businesses insight into how they can make the close more efficient.

The state of the close

Closing the books takes time – anywhere from a few days to weeks on end. While many factors can impact the time to close, including business complexity, technology, and headcount, the survey found that the biggest factors affecting close were business size and industry.

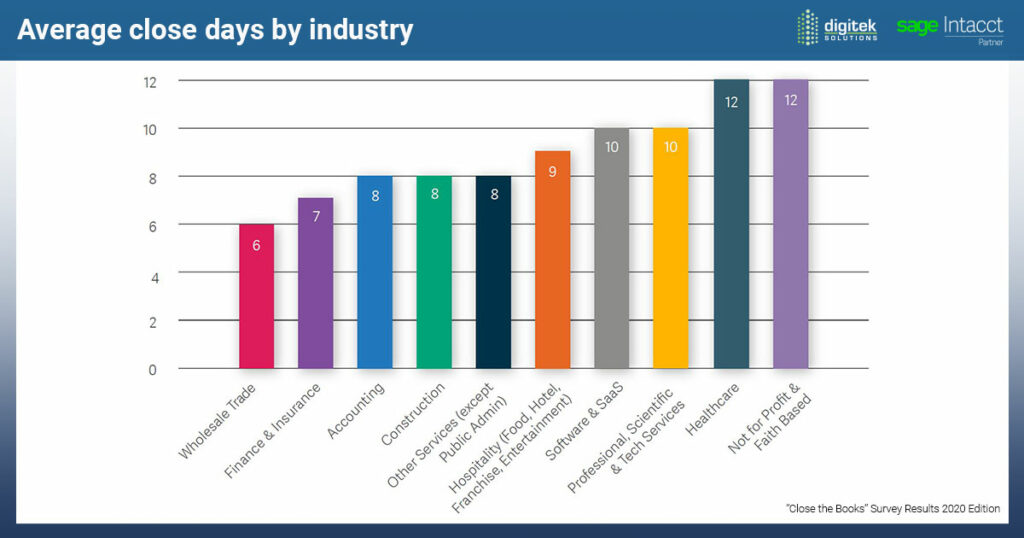

“Best in class” close time for the businesses surveyed was two weeks or less. By industry, the businesses surveyed had average close times that ranged from 6-12 days, with construction firms surveyed averaging 8 days to close.

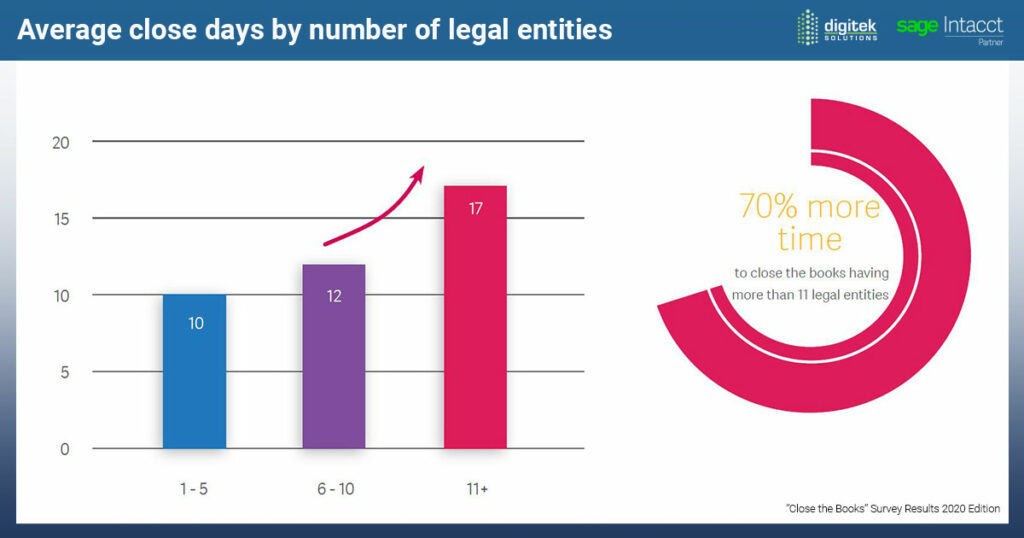

The average number of days to close the books also grew in proportion to the number of legal entities a business has. Those with 11 or more legal entities took 70% more time to close their books than those with five or less entities.

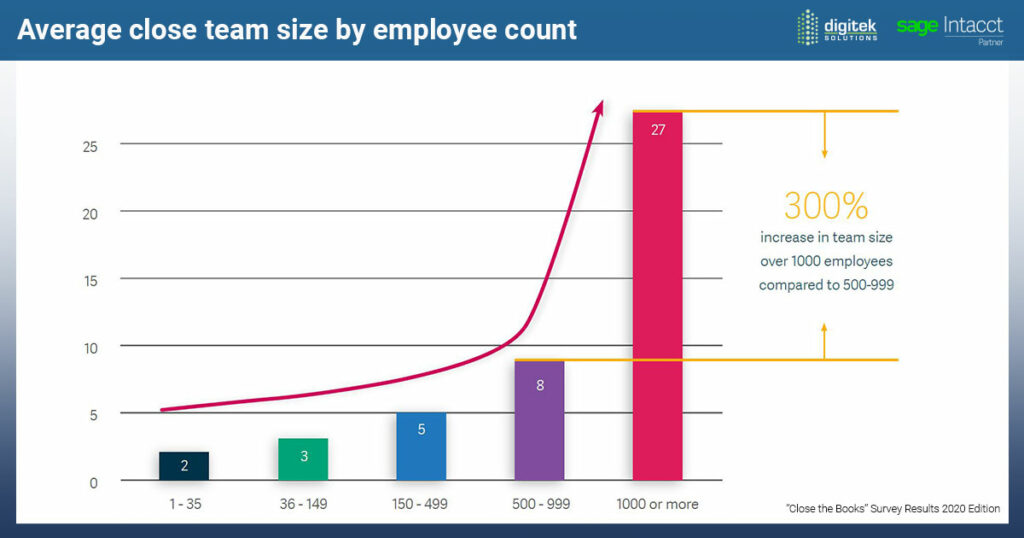

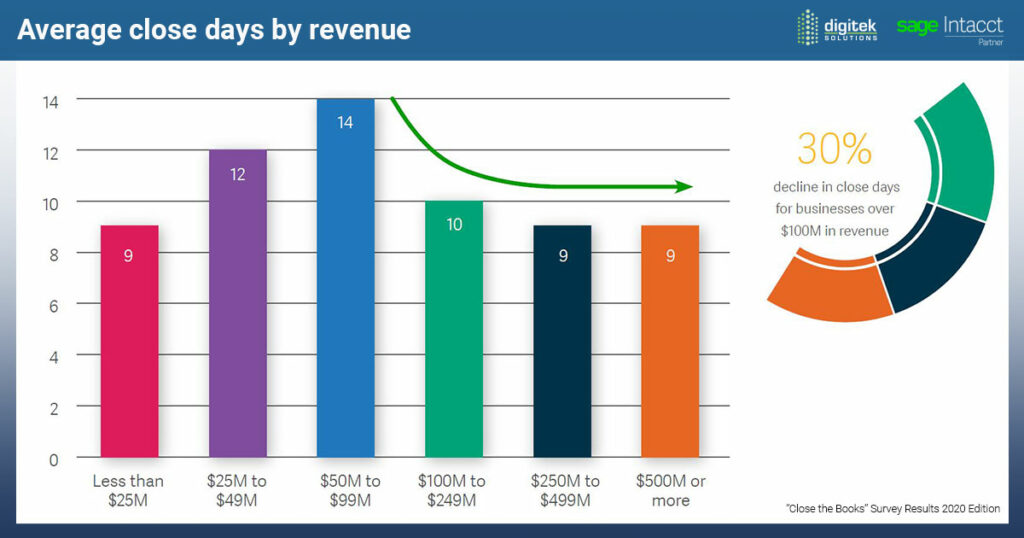

Most close teams are small, with 40% having two or fewer people and 78% having 5 or fewer. The survey found that the size of the close team grew as the total number of employees grew, with jumps at the 150, 500, and 1,000 employee count. Similarly, the size of the close team grew as revenue increased, with a near doubling of team size at the $50M revenue mark, and again at $250M and $500M, respectively.

However, it is worth noting that businesses over $100M in revenue saw a decline in the average number of close days by 30%. This can be due to efficiencies gained by increased team size and the use of technology solutions.

The role of technology

When it comes to technology’s role in the close, we are seeing the move to the cloud continue, with 63% of the respondents’ financial management systems now cloud or hybrid cloud-based, up from 58% last year. For those still using on-prem solutions, 28% plan to move to a cloud-based solution within the next year, and 42% within the next two years.

The top reasons why cloud-based solutions are preferred are higher availability, a reduced need for IT, and the ability to scale as the business grows. Other reasons included lower cost, increased security, and the ability to have advanced features such as AI.

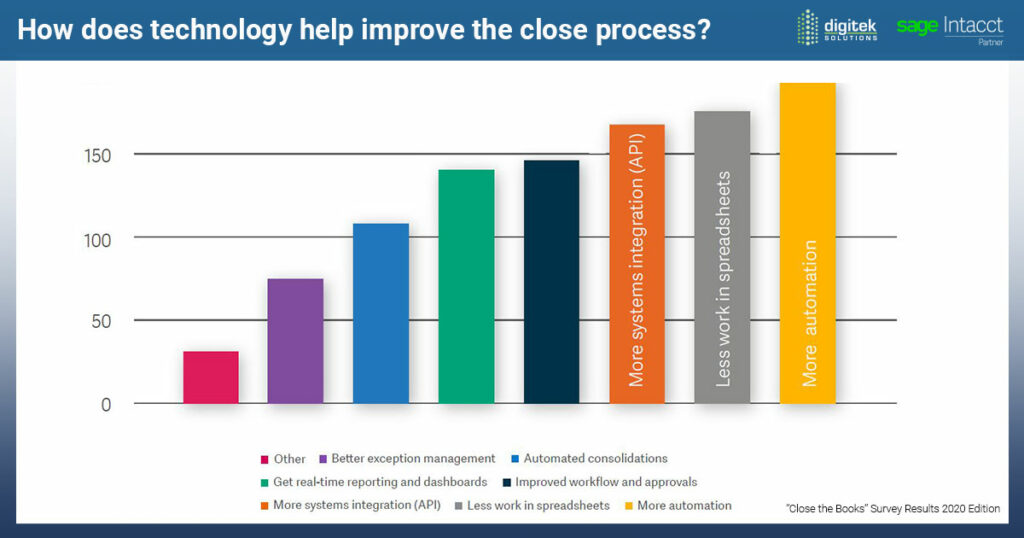

It’s no secret that implementing the right technology helps businesses increase efficiency — this holds true for the close. When it comes to how technology improves the close process, the top benefits cited were more automation, reduced manual work, and greater systems integrations. Workflow and real-time reporting were close behind.

Conversely, businesses that rely on more manual processes experience longer close times. The top factors that delay close times were investigating anomalies and the manual effort involved with the close, including accruals, allocations and imports. Other reasons included getting information from third parties, reconciliations, internal information flow, and management review.

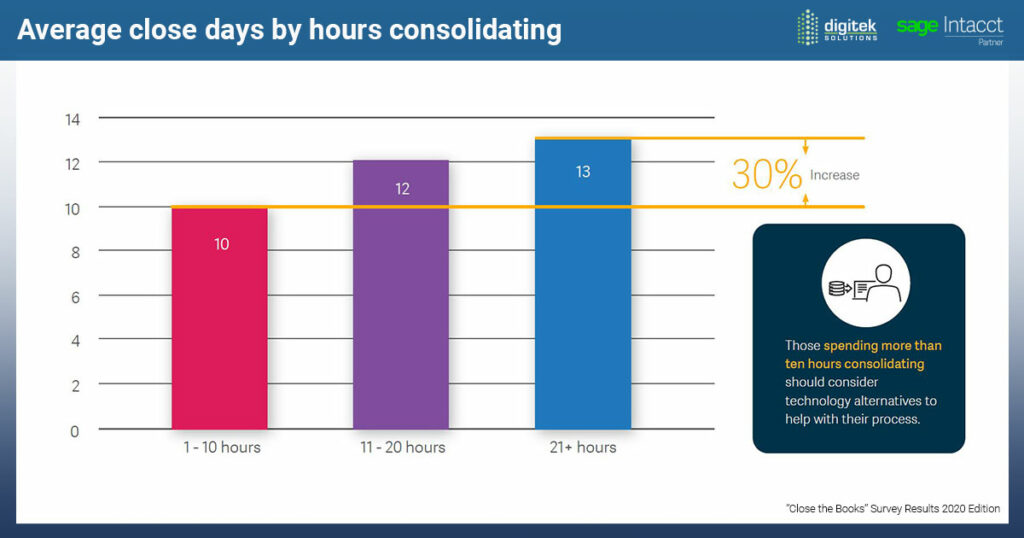

Survey results showed that manual journal entries and manual consolidations also slowed the close process. Those who do more than 75% of their journal entries manually had a close time of 33% more on average. While those who spent more than 20 hours consolidating financials had a close process of 30% longer than those who spent ten hours or less.

What the future holds

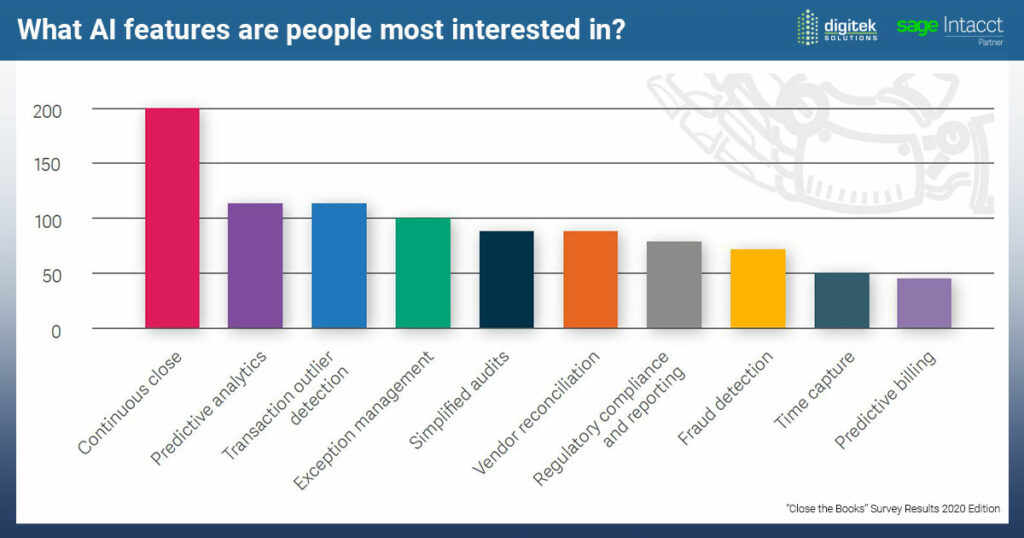

Advancements in technology will continue to help streamline the close process while wider adoption of AI and the cloud will redefine the close. AI brings exciting new possibilities such as the ability to continuously close the books, predictive analytics, and detecting transaction outliers. These advanced features are enabled through multi-tenant cloud-based solutions. Here are some ways these technologies will potentially impact the close:

Continuous close

The means of closing the books as soon as information is received is coming closer to being a reality. With information always up to date and reconciled, the need to spend the first or second week of the month closing the books could become a thing of the past. Instead of reconciling, time would be spent performing other value-added activities as needed.

Predictive analytics

Using multiple advanced features, such as data mining, modeling, and machine learning, predictive analytics allows systems to make predictions of the future based on past results. Imagine an accrual account where the system automatically calculates the amount and makes the corresponding journal entry.

Transaction outlier detection

The ability to look through large amounts of data and find the anomalies is becoming closer to reality. With large data sets and rules, AI can parse through what’s “normal” and what isn’t. Being able to quickly find the outliers means you spend less time searching and more time analyzing. As systems learn what’s out and what’s not, they become more efficient at focusing their time and energy.

The close process has been around for as long as records have been kept. Historically, much of the process was done manually but with modern technology, the close does not have to be a time-consuming process. Technology has allowed us to do more with less, gaining efficiencies and greater insight into data. It has transformed the close from backward-looking to looking directly at where we are today to where we’re going in the future with modern analytical tools that help tell us the “why” behind the numbers. Moving forward, technology will help businesses close the books faster than ever before while getting a more complete financial picture, so you can spend less time worrying about the close and have more time to focus on strategically growing your construction business.

This post originally appeared on Sage.com