Results With Sage Intacct:

Company Overview: The Hopi Tribe Economic Development Corporation was chartered by the Hopi Tribe to assist in developing the Hopi’s northeastern Arizona reservation into an economically viable homeland for present and future generations of Hopi people. A Federally Chartered Indian Business Corporation, HTEDC operates a cultural center, residential housing complex, motels, restaurants, and other commercial rental properties.

In Search of Trusted Financial Data to Reduce Uncertainty and Increase Agility

As the off-reservation economic development arm of the Hopi people in Northeastern Arizona, the Hopi Tribe Economic Development Corporation (HTEDC) runs seven diverse service entities. The organization gets several revenue streams from its motels, restaurants, and shopping centers, and also manages about two dozen non-operating, undeveloped proprieties. After a decade of using basic QuickBooks accounting software, the finance team decided they needed better financial management tools to help run this complex business and deliver more meaningful, timely reports to the CEO and board of directors.

After a lengthy search, the company decided to implement the Sage Intacct cloud ERP solution. “We wanted a scalable system that would support all of our multiple subsidiaries, which each have their own unique managerial challenges,” said Larry Chank, HTEDC’s CFO. “We looked at two other ERP solutions, but ultimately chose Sage Intacct because it is a lot more flexible for small, but complex, businesses like ours, and we knew it could keep pace with our growth.”

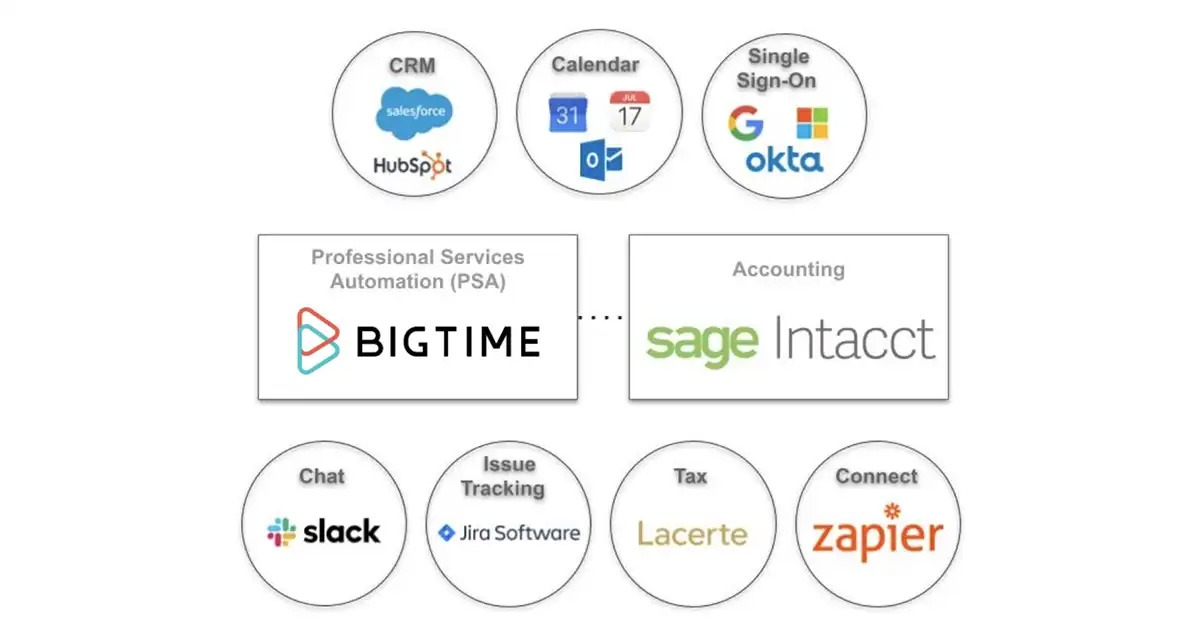

HTEDC worked with Sage Intacct partner to implement the system, configure it to the organization’s specific structure and requirements, and seamlessly integrate it with ADP payroll software.

Timely Decisions Drive Profitability and Cash Flow Improvements

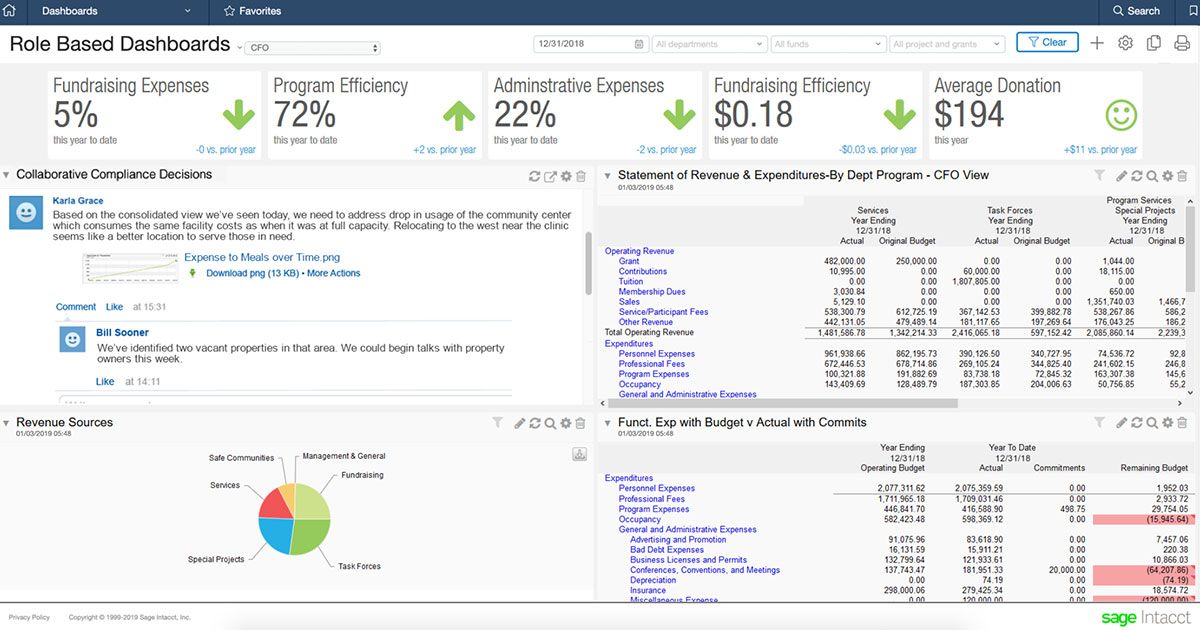

By pulling a wealth of operational data – such as motel occupancy, average daily rates, restaurant staff hours, number of meals served, and more – from HTEDC’s point of sales and inventory reports into Sage Intacct, the organization gained easy access to key statistical insights alongside financial metrics. “Sage Intacct allows us to be incredibly flexible and adjust our budget forecasting models in real-time rather than work off of months-old historical data after the fact,” shared Chank. “Literally within minutes, I can forecast what will happen to our profitability if we make a certain operational change.”

For example, by analyzing graphs of HTEDC’s motel occupancy rates and pricing over time, the team identified opportunities that boosted one entity’s annual revenues by around $350,000. Using Sage Intacct, the company’s travel plaza now sets its gross margins proactively based on the cost of incoming fuel loads versus reacting to competitor’s prices. This ensures that no money is left on the table, and improves growth and predictability.

With access to current financial data about the business, HTEDC recently reconsidered the economic potential of the tribe’s dormant real estate holdings. Chank commented, “We had done some feasibility studies years ago, but at the time the board didn’t have enough confidence to move forward with our development ideas. Thanks to the visibility we now have in Sage Intacct, they’ve approved several stalled projects, like a 200-acre multi-use retail and housing development adjacent to a new casino property.”

He continued, “Today, our board and management believe in and trust the accuracy of our financial statements and forecasts. Because they’re looking more to the future of the organization, rather than spending cycles worrying about our historical numbers, we’re able to accelerate our return on various investments.”

“With Sage Intacct, our general managers and department heads hold greater accountability, because management can quickly pinpoint areas of financial concern and have accurate information with which to make better business decisions. As a result, three of our struggling entities moved into the black, our overall gross margins improved by 20%, cash flow increased by nearly a half a million dollars, and our real estate asset values grew by over $5 million.”

Larry Chank

CFO, Hopi Tribe Economic Development Corporation (HTEDC)

Productivity Gains Help Lean Finance Team Meet Expanding Needs

Now that the finance team no longer has to spend weeks preparing reports using Excel spreadsheets, they’ve cut HTEDC’s monthly financial close from 20 business days to just seven. Sage Intacct makes it simple to produce detailed financial and management reports at the department level, the location level, and even at the globally consolidated level. As a result, executives can access financials earlier for more productive, informed board meetings that help move the company forward.

“Sage Intacct has made a world of difference for all of our day-to-day financial processes – from reporting, to accounts payable and receivable, to payroll,” noted Chank. “It requires just a fraction of the people power that we’d need on QuickBooks, and reduces our error rate. With this increased efficiency, our finance team is able to scale easily with the business. I’ve even been able to reduce headcount and increase salaries to boost job satisfaction. Sage Intacct truly makes finance fun and helps our team look outstanding in the organization.

See how Sage Intacct can boost your efficiency like Hopi Tribe Economic Development Corporation.

-

Sage Intacct 2022 Release 2 Highlights

-

The 3 Keys to Accurate, Consistent, and Timely Financial Reporting for Professional Services Firms

-

How to Build a Best-in-Class Tech Stack for Services Companies

-

Consolidated Financials: Nonprofit Multi-Entity Accounting Best Practices

-

NGO CFOs Expanded Global Impact with Data-Driven Decision Making

-

Say No to Excel! Nonprofit Finance Automation

-

Four Creative Ways Arts & Culture Nonprofits are Modernizing Finance

-

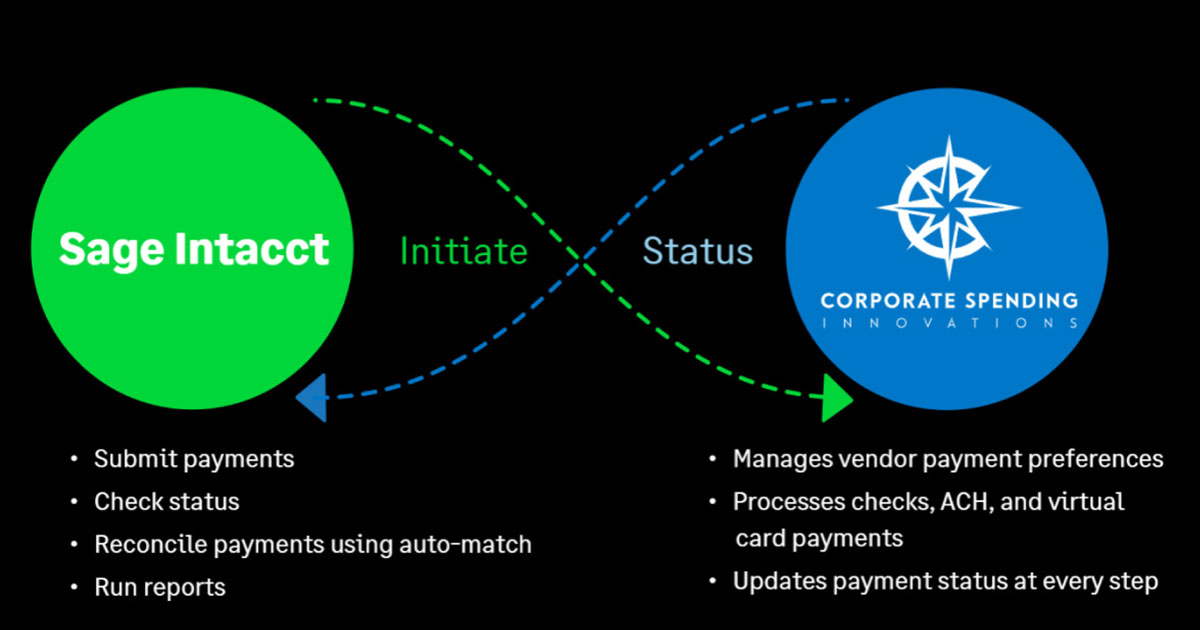

Reduce Accounts Payable Costs with Sage Intacct Vendor Payments Powered by CSI

-

Biotech Financing Outlook 2022

-

Healthcare Predictions for 2022 by Brian Bogie